EXEMPTIONS Published by. Guidelines to Apply Discount On Contribution to Community Projects and Charity.

What Items Are Duty Free At Malaysian Customs And What Asklegal My

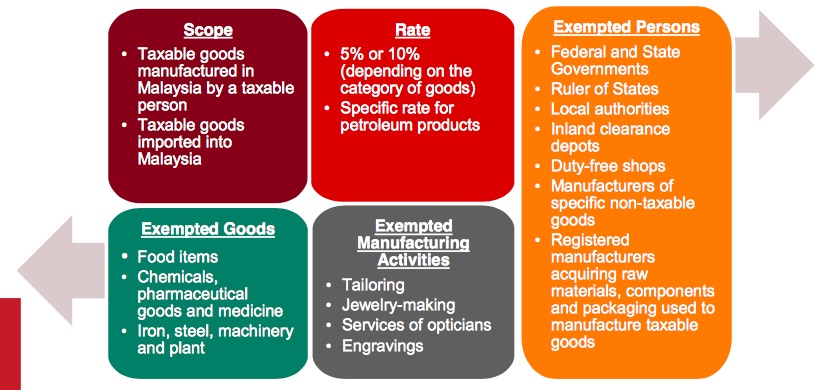

Sales tax on manufacturing importation of goods the sales and transportation of goods in accordance with the policies and legislation related to sales tax.

. These items include spare parts consumables research or testing equipment which are not produced locally. Tuesday 24 Mar 2020 927 PM MYT. Duty exemption on raw materialscomponents 1.

The Customs Duties exemption Order 2017 provides dispositions on persons exempted from the payment of customs duty on goods mentioned in the schedule of the order. Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya. September 2015 Malaysia.

When shipping a package internationally from Malaysia your shipment may be subject to a custom duty and import tax. This facility is subject to the followings. From 1 April 2022 Malaysias public health measures were eased and our borders are now open for business.

Application for Import Duty Exemption on Raw Materials Component. Full excise duty and sales tax exemption on the locally manufactured EVs from 1 January 2022 to 31 December 2025. The Malaysian authorities updated information with regards to the sales tax exemption.

Produce for domestic market Full exemption from import duty will be. 100 import duty and excise duty exemption will also be given to imported CBU EVs from 1 January. Sales tax administered in Malaysia is a single stage tax imposed on the finished goods manufactured in Malaysia and goods imported into Malaysia.

SALES TAX CONCEPT 4. Import tariff On 18 November 2008 the Malaysian government adopted the document Measures To Address Impact Of Global Economic Slowdown On Malaysias Trade And Industry which provides for the full import duty exemption on raw materials and intermediate goods. Entry into force notes.

KUALA LUMPUR March 24 The Ministry of Finance MoF has exempted import duty and sales tax for the purchase of medical and laboratory equipment personal protective equipment PPE and disposable products by any parties donating to the Ministry of Health MoH to help address Covid-19. 1 Raw materials and components are imported or purchased from a licensed factory owner. Royal Malaysian Customs Department Internal Tax Division Putrajaya 28 August 2018.

Guideline on 50 Excise Duty Exemption For the Purchase of 4WDs by Tour Operators. Amendment to Excise Duties Customs Duties and Sales Tax Exemptions Amendment to Excise Duties. KUALA LUMPUR March 23 The Ministry of Finance MoF has approved the import duty and sales tax exemption on face masks for the domestic market.

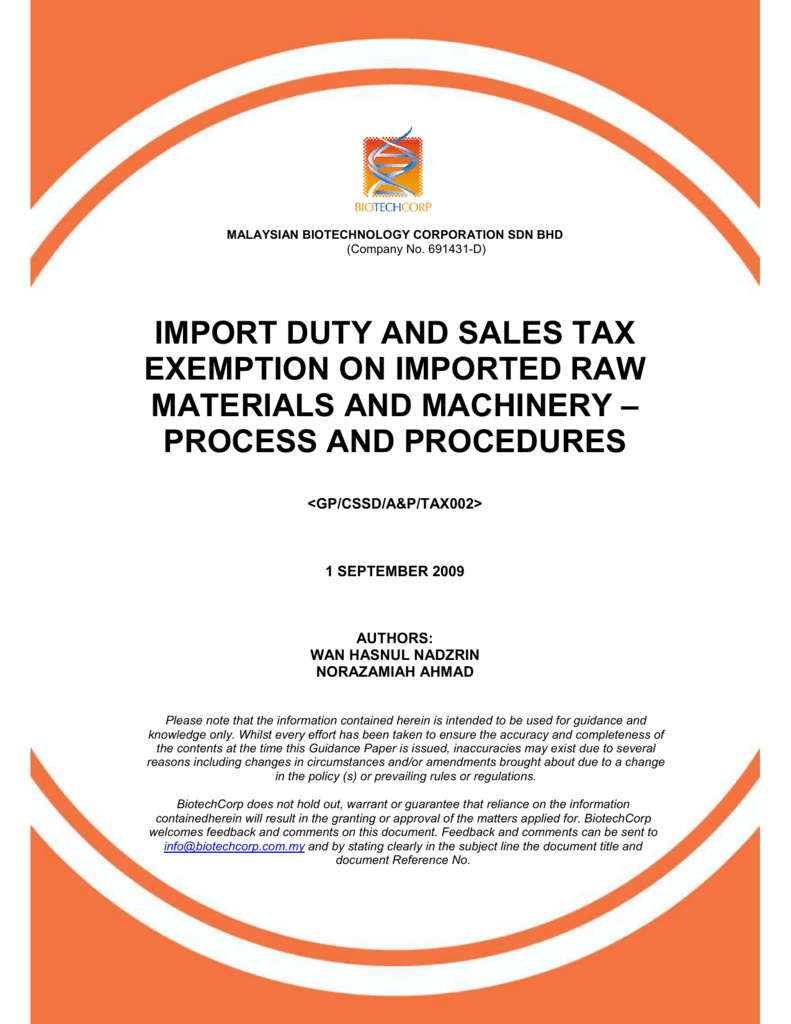

Malaysia applies tariff rate quota TRQ on selected agricultural products such as chicken milk and cream hen eggs cabbages. On 14 September 2015 the Malaysian Prime Minister announced that 5-30 import duty exemptions will be given to approximately 90 items used in the manufacturing sector. Application for Import Duty andor Sales Tax Exemption on Machinery Equipment.

Trying to get tariff data. Customs Duties Exemption Order 2017. Application for MIDA Confirmation Letter Surat Pengesahan MIDA SPM for Import Duty andor Sales Tax.

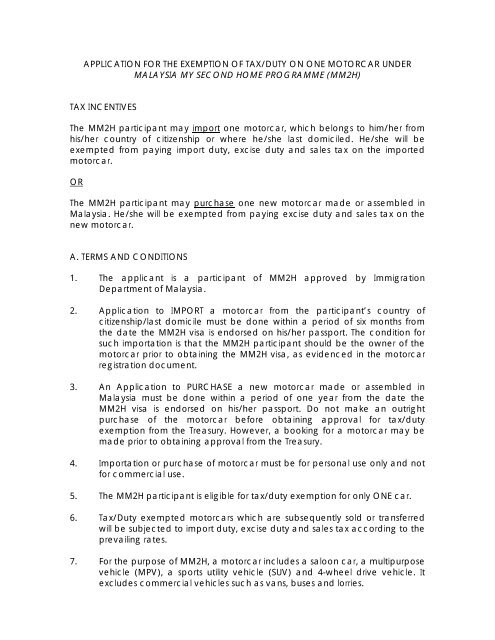

As for the import duty for the exportation of products under HS 84314990 from China to Malaysia the import duty in 2010 is 10 and this is the MFN rate as this product is listed under the Malaysias Sensitive List. And the minimum time frame requirement for a visitor to visit Malaysia or for a Malaysia resident to be absent from Malaysia is 72 hours for any mode of travelling other than air mode and 48 hours through air mode in line with the existing. Guidelines Of 100 Exemption Of Excise Duty On Vehicle For Orang Kurang Upaya OKU Type Inability Physical Defects Dumb Hearing Defects Budget 2007.

Produce for export market Full exemption from import duty will be considered on imported direct raw materialscomponents which are not available locally or where they are available locally are not of acceptable quality and price. Up to 128 cash back Estimate your tax and duties when shipping from Malaysia to Malaysia based on your shipment weight value and product type. Included HS Code 22029910 00.

This facility is provided to provide tax exemption on raw materials and packaging materials used by local factory manufacturers to make tax exempted goods for the export market. This is in addition to 319 items which. Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia.

In operation 3 January 2018. As such import duties of 10 will be imposed and no exemption will be given. Companies can now apply for import duty andor sales tax exemption on Machinery Equipment or Import Duty Exemption on Raw Materials Component via Invest Malaysia Portal at investmalaysiamidagovmy.

Import duty andor sales tax exemption on machineryequipment for selected activities in Agriculture Sector Import duty andor sales tax exemption on machineryequipment for Selected Services Sectors which include Research Development RD Private Higher Education Institution Private Higher Training Institution science technical or vocational and. Import tariff On 24 March 2020 the Malaysian Ministry of Finance announced an exemption from the customs duty and sales tax on the purchase of medical and laboratory equipment personal protective equipment and disposable products by any parties if it is to be donated to the Ministry of Health to address the COVID-19 pandemic. Image from TheMemo Although youre technically an importer you usually dont pay import taxes because under the Customs Duties Exemption Order 2013 every person entering Malaysia is exempted from paying duty on.

Effective 6 August 2021 amendments pertain to the following among other measures. The government is cognisant of the difficulties faced by the rakyat in obtaining face masks due to the sharp rise in demand said its Minister Tengku Datuk Seri Zafrul Abdul Aziz. A raw materials and components.

The public is. Substituted HS Code 04039090 60 with 04039090 90. Any portable objects you use on a regular basis but excludes household items this means whatever you packed as luggage for.

SALES TAX 2018 GUIDE ON. Every country is different and to ship to Malaysia you need to be aware of the.

St Partners Plt Chartered Accountants Malaysia Customs Announcement Import Duty And Sales Tax Exemption On Kn95 Type Face Mask Facebook

Malaysian Customs Import And Malaysian Customs Import And Export

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

Import Duty And Sales Tax Exemption On Imported

De Minimis Rate In Malaysia Janio

What Are The Sst Exempt Ckd Cars You Can Buy In Malaysia In 2021 Wapcar

Atiga National Guideline 8 Jan 2015 13 Miti 15 1 2015

Bringing In Personal Car With Duty Tax Exemption Malaysia My

Pcservices2007guidelines Sept2007 Doc

Customs Department Unilink Group Of Companies

Registration Form Federation Of Malaysian Manufacturers

Briefing On Import Duty And Or Sales Tax Exemption On Raw Materials And Components Mida Malaysian Investment Development Authority

Import Duty And Sales Tax Exemption On Imported